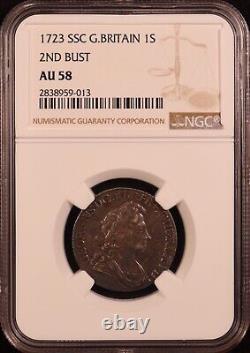

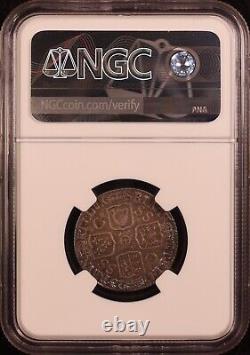

1723 Great Britain Silver Shilling 2nd Bust South Sea Company -NGC AU58! Rare

1723 Great Britain Silver Shilling "2nd Bust" South Sea Company - NGC AU58! Wonderful Iridescent Toning Throughout its Surfaces! Very Rare "2nd Bust " Variety!

Only Two Graded Higher at NGC! The South Sea Company "Bubble:".

The South Sea Bubble has been called: the world's first financial crash, the world's first Ponzi scheme, speculation mania and a disastrous example of what can happen when people fall prey to'group think'. That it was a catastrophic financial crash is in no doubt and that some of the greatest thinkers at the time succumbed to it, including Isaac Newton himself, is also irrefutable. It all began when a British joint stock company called'The South Sea Company' was founded in 1711 by an Act of Parliament. It was a public and private partnership that was designed as a way of consolidating, controlling and reducing the national debt and to help Britain increase its trade and profits in the Americas.

To enable it to do this, in 1713 it was granted a trading monopoly in the region. Part of this was the asiento, which allowed for the trading of African slaves to the Spanish and Portuguese Empires.

The slave trade had proved immensely profitable in the previous two centuries and there was huge public confidence in the scheme, as many expected slave profits to increase dramatically, especially when the War of the Spanish Succession came to an end and trade could begin in earnest. It didn't quite play out like that however. The South Sea Company began by offering those who bought stocks an incredible 6% interest. However, when the War of the Spanish Succession came to an end in 1713 with the Treaty of Utrecht, the expected trade explosion did not happen. Instead, Spain only allowed Britain a limited amount of trade and even took a percentage of the profits.This was unlikely to generate anywhere close to the profit that the South Sea Company needed to sustain it. However, King George himself then took governorship of the company in 1718. This further inflated the stock as nothing instils confidence quite like the endorsement of the ruling monarch. Incredibly, soon afterwards stocks were returning one hundred percent interest.

This is where the bubble began to wobble, as the company itself was not actually making anywhere near the profits it had promised. Instead, it was just trading in increasing amounts of its own stock. Then, in 1720, parliament allowed the South Sea Company to take over the national Debt.Or better yet, swap the stocks for the debt interest directly. It was a self-perpetuating cycle, but as such, lacked any meaningful fundamentals.

The trade had never materialised, and in turn the company was just trading itself against the debt that it had bought. Then in September of 1720, some would say an inevitable disaster struck. Investors were ruined, people lost thousands, there was a marked increase in suicides and there was widespread anger and discontent in the streets of London with the public demanding an explanation. However, even Newton himself couldn't explain the'mania' or'hysteria' that had overcome the populous.

Perhaps he should have remembered his apple. The House of Commons, wisely, called for an investigation and when the sheer scale of the corruption and bribery was unearthed, it became a parliamentary and financial scandal. Not everyone had succumbed to the'group think' or'speculation mania' however.

A vociferous pamphleteer by the name of Archibald Hutcheson had been extremely critical of the scheme from the beginning. The person that came to the fore to sort out the issue was none other than Robert Walpole. In an effort to prevent an event such as this from happening again, the Bubble Act was passed by parliament in 1720. This forbade the creation of joint-stock companies such as the South Sea Company without the specific permission of a royal charter. Somewhat incredibly, the company itself persisted in trading until 1853, albeit after a restructuring.

During the'bubble' around 200'bubble' companies had been created, and whilst many of them were scams, not all were nefarious. Today, there are many commentators drawing comparisons between'Cryptocurrency mania' and the South Sea Bubble, and note that,'promoters of the Bubble made impossible promises. Perhaps historians of the future will have cause to look back with similar incredulity on today's market. Please Check out Our Web Site : antebellumnumismatics.Please reach out to us if you have any questions about any listings you see. ALL Precious Metals tested with our own Sigma Metalytics Precious Metal Tester and guaranteed genuine. The only exception is when items are damaged, tampered with, or removed from holders. All Bullion or Silver Sales are final as market conditions are constantly changing. Please check out our other listings!

We have auctions almost every week so make sure to follow us! Follow our owner on Instagram as well at... At Antebellum Numismatics LLC we try to offer a wide variety of items including graded and ungraded coins from modern to bust series, paper currency, obsolete and confederate currency, exonumia such as civil war and hard times tokens, world coins such as thalers and numismatic medals, and we are always listing interesting items as well as many rare key dates. And many other interesting items like shipwreck recovered coins and ancient coins. We pride ourselves on having outstanding customer service.Coin grading is subjective and all coins can be interpreted differently, so we try to post very large, up close shots of each item we list. Be sure to take a close look and come up with your own opinion! We are a family-owned small business and appreciate your business and feedback.